|

Was cleaning out my desk and came across a list of fourteen principles for living I got from my 5th grade teacher. The tips are good, and, as a personal exercise, I decided to grade myself on how well I’m currently executing on each one. I challenge you to do the same.

They should really offer these type of lectures before your last day of college. Maybe we aren’t ready to hear them until our “education” is complete. Either way, below are a few of my favorite commencement addresses. Please comment below with links to your favorite commencement address.

1. David Foster Wallace, author of Infinite Jest A must listen for every grad, and adult. Foster Wallace flexes his intellectual muscle and offers a dose of reality for the grads and families listening on.

2. Neil Gaman, author of The Sandman: Overture

A 20 minute speech on the artistic process, how you find your path, and the advice he wished he’d taken.

3. Stephen Colbert, late night talk show host

Colbert has given a number of commencement addresses over the years, but his 2011 rendition for the graduating class from Northwestern University is particularly witty. Returning to his alma mater, Colbert laces his 20 minute talk with plenty of jokes and post-grad wisdom. The best insights kick in around 12:30.

4. Ellen Degeneres, daytime talk show host

Ellen never went to college, but she grew up in New Orleans and celebrates with Tulane’s graduating class post-Katrina. She acknowledges that they still really don’t know who they are going to be or what they are going to become, but if they stay true to themselves, they’ll be alright.

5. Steve Jobs, founder of Apple

More than a decade ago, the legend tells three stories from his life and encourages everyone to make the most of limited time. If this piqued your interest, check out a website dedicated to wisdom for graduates. This is the fourth part of a four part series on personal finance basics. Check out parts one, two, and three when you get a chance. There are a multitude of reasons to save, such as; a down payment on a house, your child’s college tuition, and retirement. Priorities will change over time, but saving is always a prudent idea. The issue arises when you don’t know what you’re saving for, it needs to feel important so give yourself some objectives. Priorities 1. Emergency Fund What happens if you lose your job or are injured and can’t work for 8-12 weeks? Can you support yourself? Recent surveys have indicated that more than 50% of Americans do not have enough in the bank to cover three months’ expenses. This should be your first and most pressing priority. Experts generally recommend having six months worth of living expenses in your emergency fund, but you should have even more if you are starting a family or have a significant mortgage. Cut back on all your expenses and tighten the budget until you get this done. Once you’ve put together the 6 months of dough, put it in a separate account that you can’t touch for everyday expenses. 2. Investing in Assets Assets are the opposite of disposable goods (toilet paper, food, cleaning supplies). They are going to stick around and make a positive impact on your balance sheet. Assets can come in many forms, think stocks, bonds, real estate, etc., and starting to build assets will benefit you years down the road. 3. Opportunity Fund Are you going to be buying a house, proposing to someone, or paying for a wedding sometime soon? Those are all expensive propositions and you should start setting money aside now. You might be thinking to yourself, “that’s all well and good, I have an emergency fund and want to start investing, but I have no idea where to start.”

You’re not alone. Lots of people feel out of their depth since this isn’t something you usually learn in school. Plenty of people dedicate their lives to learning how to invest in stocks and bonds, but the most important thing is that you stick to a plan once you get started. The biggest investing mistakes are made when investors don’t have a plan and make emotional decisions. Investing Basics Investing is its own unique language. Roth IRAs, 401ks, brokerage accounts, the list goes on and on. What do you need to know? There are entire books written on the subject so don’t expect a sufficient education here. To start:

Odds and Ends It’s best to save at least 10% of your income. Over the years, try to work up to 20% before you get married or have kids. Take more risks in your 20’s and 30’s as long as you pledge not to sell out of your positions when the market inevitably corrects every 5-7 years. Life insurance is a must-have for anyone with a family or a co-signer on private loans. Make sure your loved ones are taken care of. Further Reading A Random Walk Down Wall Street by Burton Malkiel A Wealth of Common Sense by Ben Carlson This has been a four part series on personal finance basics. Check out parts one, two, and three if you missed any of them. This is part three of a four part series on personal finance basics. Parts one and two are linked, but not required to read this post.

The story of a mid-20s millennial burdened with student loan debt, still living at home, is so oft-repeated that it has risen to some level beyond cliche. However, living through the 2008 recession has also left this generation in a more mindful state, conscientious of the risks of investing. While developing a fancy investment strategy sounds fun to some, it is more important that your 20s are spent focusing on the fundamentals. Setting yourself up for success means paying off debt and learning how to budget. Practicing this delayed gratification will be hard at first, but will become easier as it develops into habit. Paying Down Debt There are a number of personal finance coaches who espouse the notion of “good debt” and “bad debt”. Good debt has a low interest rate and was used to buy an asset of value, that could appreciate over time (think of a mortgage for a house). Bad debt has high interest rates and might have been used to buy a depreciating asset (think credit card debt or car loans). The reality is all debt is a limiting force that inhibits you from seizing new opportunities. For example… You are working at a medium sized corporation and your friend approaches you with an offer to join her fast-growing startup. You’d take a 50% pay cut, but get significant equity and the chance to take on a lot more responsibility. You’d love the experience, but your large monthly mortgage and car payments mean you’d barely have money for food and gas. These large immovable payments are known as “golden handcuffs”. Don't let them slip on. Your 20s are a time to be humble and thrifty. Just as it’s a bit obnoxious to think that you’ll be in the c-suite by 26, you shouldn’t be trying to live a lifestyle of someone who’s made it. Quite the opposite in fact. The more money you can sink into you student loans and credit card debt, the less interest you’ll end up paying to the lenders you borrowed from. Paying down the principal of your loans aggressively will afford you the flexibility and options to make real choices as you get promotions and raises. Start with your highest interest debt and work your way down (don’t ever forget to make minimum payments on everything). As you pay off debts, it will snowball as you have more cash flow to aim at fewer targets. Restrictions as a Path to Freedom (aka Budgeting) Most people live like this: Income - Consumption = Saving & Payments Budgeting maestros flip the script to something better: Income - Saving & Payments = Consumption What does this actually mean? Most people live their lives feeling guilty because they spend first and save second. Whatever is left over at the end of the month gets pushed into savings, fluctuating significantly month to month. Along with being inefficient, this is a more mentally taxing system of saving. Each purchase is accompanied by a small (or large) pang of guilt, because you see each dollar spent as savings lost. When you save first, by automating your monthly savings, you actually release yourself of guilt, knowing that you can spend whatever’s left, because the saving has already been done. Automation So how can you make this automation a reality? Through your direct deposit preferences or your bank’s online services; you can select a percentage or fixed dollar amount to be regularly moved into specific accounts. Allocating a specific amount to savings and debt repayment allows you to enjoy the rest of the money that’s leftover, guilt-free. Automating your loan repayment means you’ll never miss a payment, and can sometimes get your interest rate reduced slightly. Resources Mint - One stop shop for budgeting and getting a full picture of your finances Mr. Money Mustache - Blog with a cult-following where you can get a “personal finance PHD” Budget Simple - Another, more simplified budgeting tool This is part three of a four part series on personal finance fundamentals. Check out part one and two if you missed them.

So I had a successful Kickstarter campaign and had a lot of people to thank. I also had a lot of rewards to coordinate and send out (to understand how I made it all happen, read here).

But, once the money has been deposited in your account, what next? The job is certainly not over. Instead it become primetime to execute. 1. Buy the Gear This was fun. Honestly, the arrival of new microphones were more exciting than Christmas this year. Is that lame?

Audio-Technica BPHS1 Broadcast Stereo Headset with Dynamic Boom Mic

One thing I’ve noticed in my interviews is that guests are often not accustomed to talking into a microphone and tense up when they hold a mic. This headset will relieve my guests of worrying about making sure their mic is the right distance from their mouth. Bonus: Folks like me who talk with their hands get free reign. 2. Start a Newsletter Despite the proliferation of social media, only Facebook has reached ubiquitous adoption. I share some of my most popular posts and podcasts there, but I don’t get the maximum reach. So how do I make sure I’m engaging with my listeners and readers on a regular basis? The one messaging platform everyone uses. Email. Now, I know that I’m not alone in the fight to Inbox Zero, and I don’t want to barrage people with emails. So, I’m launching a monthly newsletter to summarize the finest things from the internet. It will serve as an extension of the digital content curation I’m already doing and distill it down to only the highest-caliber videos, links, podcast episodes, and gear. A majority of my Kickstarter backers already signed up and provided valuable feedback on what they wanted to see. I would have never tried this is I wasn’t able to survey my backers as part of the fulfillment process. If you want to join in, just drop your email below.

3. Start soliciting more sponsors

My top rewards for my Kickstarter campaign offered sponsorship opportunities for episodes of my podcast. I’ve already released episodes sponsored by the Ultimate Athlete Project, and I’m currently working with the other companies to write copy and record the sponsor spots. Seeing four organizations interested in sponsoring helped move up my timeline to find other sponsors for the show. I’ll be adding a “Sponsors and Partners” page to help move the show and blog closer to financial sustainability. This would have never happened if it hadn’t been for the Kickstarter campaign. 4. Fulfill the Rewards This has been a (tiring) blast so far. I am prioritizing my largest backers and working my way down. It’s been a larger job than I anticipated. Trips to the post office to mail t-shirts around the country and scheduling coffee dates is nearly a full-time job in itself. Luckily, I’m more than halfway done and should have everything wrapped up by the end of January. The coolest part has been getting coffee with backers and learning more about what they are doing. That was the motivation behind the podcast and continues to be my favorite thing to do. Takeaways I learned so much through every step of the process of running my campaign. I’d urge anyone with a project or business idea to try their hand at running a campaign. I guarantee you will grow in ways neither of us can predict. Be ready to put in the work and bring your creativity.  The pursuit of a goal, be it professional or personal, can be all-consuming. It is very easy to put on blinders and hone in on a single outcome defining personal success or total failure. There is nothing wrong with an earnest campaign. But remember, you are not simply following some predetermined course that Google Maps dictated to you. You are hiking. On the trail, hikers have a distinct end goal in mind. Get to shelter. Trek twelve miles today. Complete the journey. They will certainly come across segments of the trail that require all-consuming focus and perseverance. The crossing of a some uneven terrain, or climbing a 20 degree grade for two miles. There is a lot less talking and joking going on between a party of hikers when they meet these obstacles, as each person turns inward for their core motivations and base instincts. However, the hiker also takes breaks to sit on the side of the trail and take in nature's beauty. They know they should drink in these views that will be unattainable just a mile down the trail. The hiker knows that these images will be burned into their memory and just like the pain and determination that was required to climb the peak. The same truth applies to every step of your personal journey. There is beauty in the furrowed brow of your colleague next door, the late night, slightly misspelled email outlining a new idea, the taste of the coffee propelling you into motion, and even the familiar face of the parking lot shuttle driver. No matter what goal you are pursuing, no matter how well you've laid your plans, always be on the lookout for the grand view waiting for you to stop and look up. Every step of the trail offers an unnoticed spectacle waiting to be appreciated. Being present in such moments will fill you with a renewed energy that will propel you forward with an incomparable vigor. Happy trails, Aaron Going to a networking event can be daunting, especially if you aren’t a regular. Whether you are attending for business reasons, to make friends, or just blow off some steam, keep in mind these important tips. Do’s Find a way to be involved in leadership Every networking organization has a few SuperConnectors in their midst. These are the folks that have 100s of LinkedIn connections and are happy to help you out without expecting anything in return. These are the people that you want to meet, and the best place to find them is in the leadership committees and boards for the networking group. Ask around and you will find them quickly. Caveat; Only take a leadership position if you can handle the time commitment and want to contribute. There is real work involved and it needs to be done properly. Step out of your comfort zone and introduce yourself Walking up to a stranger and introducing yourself can be daunting. The reason you are at a networking event is because you get to be with a bunch of people who have self-selected themselves for this type of event. That doesn’t mean that 100% of people will be your soulmate or next business partner, but you’re going to get a lot of smiles. Even if you aren’t in a client-facing role at your current company, social skills are a key trait to develop. Being comfortable making face-to-face conversation is a key skill. If it helps, see the hour or two as a gym session for your social skills. Follow up with the folks you meet on LinkedIn/Email Always grab a business card and keep a pen handy to write down a detail about the person or your conversation. You should definitely have a LinkedIn profile and try to reach out to all of the people that you talked to for more than 3 minutes. Save emails for the folks who aren’t on LinkedIn or to follow up about specific intros or business opportunities that you discussed in person. Caveat; A lot of people make a big deal out of how long to wait before following up. If you are at a huge networking event or conference, then it probably makes sense to wait 3 days or so to follow up. For a small gathering, 1 day is plenty. Don'ts Try to pitch anybody at the event This is a really bad look. If someone asks, feel free to give a brief explanation of what you do. But you are not going to close or sell anyone at a networking event. If there is genuine interest then ask for a meeting or call another day. Pitching at these events is a turn-off and reeks of desperation. Give up after one event The first event can feel like the first day of high school. Regulars congregate to catch up. Newbies hang out on the periphery. Even if the first event doesn’t go so hot, things will get better at you second and third events. After three, you’ll have a solid feel for the group and be able to make a reasonable decision about continuing to attend. Worry about meeting everybody, aka “fast-food networking” Even at a small event, it is unlikely, and unnecessary, that you try and meet everyone. If you rush from person to person dropping business cards, you are going to be forgotten or worse, not taken seriously. If you spend a whole event talking to one or two people, this is not a loss. In fact, you probably took important steps towards forging a new friendship.Make it a goal to focus on making one or two deep human interactions per event. Caveat; Don’t linger or butt in. Social awareness trumps all. Benefits By using the above Do’s and Don’ts, I was able to transform my network and even take a role in leadership in my own community with Pittsburgh Young Professionals. PYP provides career minded individuals with opportunities to develop socially, professionally, and civically. As a membership committee member, I help break down the awkward invisible walls that you might experience at networking events by being a friendly and engaging co-host while encouraging first-timers to sign up for membership or to become more involved. While I love the events, the internal committee meetings may be even better. Since jumping on board in a leadership role, I’ve quickly realized how many driven individuals make up PYP’s leadership. Watching other extremely high performers conduct themselves while putting others first is a valuable, educational experience, and I learn so much from listening and interacting with local peer leaders. Being able to play a part in PYP greatly improving its member retention and total membership has been challenging, but most importantly, it confirms to me as to why you should be involved in a leadership role within your community. Kenny Chen (far left) has introduced me to 4 of the guests who have come on my podcast. Ryan (far right) regularly sends me inspirational articles. More importantly, I have made real friends who are invested in my success as much as I am in theirs.

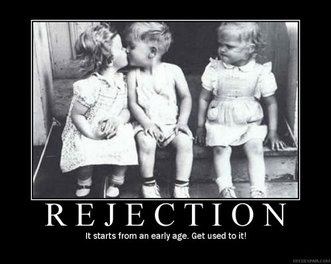

Overall, through my experience with PYP and other networking groups, I’ve challenged myself to become a SuperConnector by focusing on making introductions that can benefit others first. Approaching networking with faith and a long-term mindset allows me to avoid worrying about trying to talk to everyone or not giving a social group only one chance. I know that any introductions that I make now will come from a mindset of improving the Pittsburgh young professional community, which will in turn, help me reach the next level in my own career. Bring this mindset to your next networking event, and I’m confident you’ll find it a success.  I recently sent a great article about raising funding as a first-time founder to my friend and colleague at the startup I work for. After the link I added, “Do you want me to keep sending you stuff like this? I'm not offended by No.” Those last five words sprung from my fingertips naturally and unconsciously, but I stared at them for a while before pressing send. These words signaled an important development in my personal growth. No can hurt. Really bad. When I got cut from the soccer team as a sophomore, I laid on the floor of my room and cried. When I threw the last turnover and lost the last game of my college ultimate career the message “You’re not good enough” came in loud and clear. I cried then, too. As an insurance salesman, I had more people hang up on me in one year than I thought I’d experience in my entire life. But, every time I got back up, dusted myself off, and kept on plugging away. And that is what will come to ultimately define me. When you’ve gotten back up enough times after being spurned, you’ll come to realize your own invincibility. That you have the courage, fortitude and experience to make the rejections bounce right off of you. After that, things will really start to change. That self-belief makes you more attractive to employers, potential lovers, and teammates. They will feed off of the charisma that is borne from authentic, balanced confidence and reasonable expectations. That’s why those five words meant so much to me. Now don’t get me wrong, it’s not a monster that I’ve slain. It would be ridiculous to equate sharing an article with some of the other “No”s I’ve faced. But it’s a step in the right direction, down a path that I’m excited to travel. If you need some inspiration, go watch Jia Jiang’s 100 Days of Rejection TED Talk, but, honestly, the best way to learn is through experience. So go out there and hear some Nos. |

Topics

All

If you want to support this blog, buy your Amazon products through this link.

Archives

August 2020

|

RSS Feed

RSS Feed