|

The best stuff from all around the web; read, learn and prosper.

Why do I write so much (Ryan Holiday) The world capital of female-founded startups (Fortune) How to pick a life partner (WaitButWhy) Should you go to grad school (Quartz) Networks are hard, and must be additive (Points and Figures) Is using “smart drugs” cheating? (Brain Report) Attention is the currency of media and tides are changing (Medium) Understand and use the 80/20 principle (Entrepreneur) Be sure to share your favorite links.

The best stuff from all around the web; read, learn and prosper.

World champion javelin thrower learned his craft from YouTube (Washington Post) China is crashing but Americans should not worry (Bloomberg) When did we all become curators? (New Republic) Protect yourself from monotonically increasing confidence (Paul Graham) Building a digital magazine in 15 months (Venture Harbour) Bertrand Russell argues against the superior virtue of oppressed people (Reading Russell) Bonus Lolz - Everyone who has followed Fast Money’s advice now rich (Onion) Be sure to share your favorite links.

Enjoy your Saturday morning and these compelling articles.

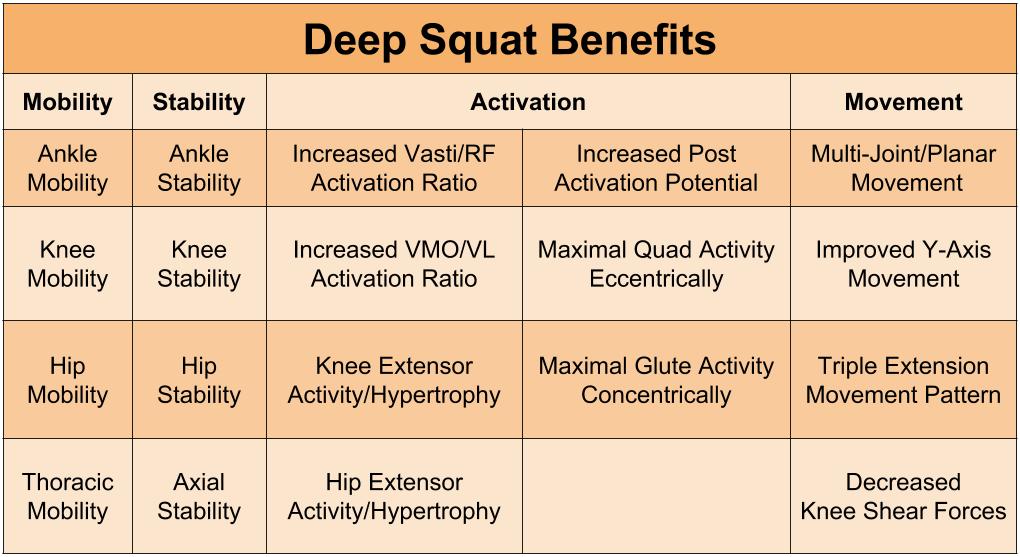

Tesla is going to change everything. Seriously. (WaitButWhy) Brad Katsuyama’s IEX is about to make the next step (Bloomberg) Apple is poised to revolutionize cable bundles (Above Avalon) The science of addictive junk food (NYT) The new iPhone is coming, here’s what to expect (MacRumors) VERY LONG - Startup class with Sam Altman (Sam Altman) Surfing Mavericks (N+1) Do you have good hip mobility? Better question, do you even have average hip mobility? Do you even know how to quantify an average amount of hip mobility? I recently came across this article detailing Ido Porter‘s 30/30 squat challenge. The goal of the challenge is to counteract the damage being done by our increasingly sedentary lifestyle. Ido Porter is an Israeli movement guru with an intense passion for getting himself and others moving. In a world where many of us are stuck in front of desk, the consequences of failing to move could be life threatening. I’m 23 years and I have already had hip surgery to repair a cab impingement, pincer impingement and torn labrum in my right hip at the ripe old age of 21. I learned a lot from my phenomenal physical therapist about the importance of hip strength and mobility during my 6 month rehabilitation. However, once I was left to fend for myself, I realized how difficult it was to maintain the strength and flexibility I had been working on for the past half year. Sitting for extended periods of time, like every university class I took, tightened my hip flexors. Luckily, long walks to class, yoga after track workouts, and retention of physical therapy exercises kept me loose. The new health tip du jour, “sitting is the new smoking” further motivated me to be cognizant of staying on my feet. Upon starting my office job in the financial services industry, all the good habits I was working on at Pitt became much harder to maintain. I was stuck in a tiny cube, making phone calls and answering emails, while I felt my body screaming to be set free. The tight neck tie and suit jacket certainly didn’t help. Having now quit the the financial services industry, I am focused on recommiting to attaining the hip mobility and strength that came naturally to our pre-office-life ancestors. I believe Ido’s challenge will help get me there. The Challenge Spend a cumulative 30 minutes per day in a deep squat for thirty consecutive days with no rest days. These thirty minutes need not be consecutive, so I will start by taking 6 five-minute squats per day. Once this becomes easy, I will condense to fewer, longer sessions per day. After that I hope to expand past 30 minutes per day before the end of this 30 day challenge. Proper Form If you are unsure if your form is correct, observe these six rules

Good luck! I will have after photos and a reflection for you in a month. Let me know in the comments, on Twitter, or email me at goingdeepaaron@gmail.com if you are trying it out.

The best stuff from all around the web; read, learn and prosper.

Concerns over the American economy (Fortune) Hyperloop plans are getting real (Wired) Snoopy ruined Peanuts (Kotaku) AND Amazon ruined Seattle (Gawker) Richard Branson comes out in support of legalized prostitution (Virgin) Jason Bateman acknowledges Horrible Bosses 2 sucked (Hollywood Reporter) The most ambitious startup ideas are also the scariest (Paul Graham) Air pollution is worse than previously believed (Economist) Be sure to share your favorite links.

I thought the debate was entertaining before, but this takes it to a whole new level.

Bad Lip Reading is winning.

The best stuff from all around the web; read, learn and prosper.

Outdoorsy aims to be the AirBnB of RVs (Time) Elon Musk, world’s raddest man (WaitButWhy) Lessons from five years of startups (lol’d at #23) (Talking Quickly) Mean people fail (Paul Graham) The deception of urgency (StoryLine) Thinking about cars with Benedict Evans (Ben-Evans) Uber is beginning the early stages of preparing for an IPO (Reuters) Be sure to share your favorite links.

The best stuff from all around the web; read, learn and prosper.

Peter Thiel’s libertarian bent “Almost everyone either thinks by analogy or follows the crowd.” (New Yorker) Three arguments against virtual reality and why they are wrong (Road to VR) The dangers of victim politics (Little Atoms) Understanding Tesla’s formula for success (Forbes) Why people are upset about Amazon employees working very hard (NY Mag) How to deal with telemarketers (Tickld) Preparing for the impact of driverless cars (New Geography) Be sure to share your favorite links. It seems like there is a never-ending list of things to look out for and protect yourself against. Gluten, tanning beds, drugs, bad investments, pseudoscience, and identity theft all warrant varying degrees of paranoia and concern.

But I’ve learned another one that you may not be aware of. You could take financial advice from the wrong person. Below is my story, at the end are the key takeaways. Disclaimer; Everything you read below is my opinion and story. Nothing you read is intended to represent specific advice to implement in your own personal finances. ---------------------------------------------------------- I started as a financial representative for a large financial company right out of college. After approximately 3 months of training, I was sent out into the world to start acquiring clients that would eventually sustain my own financial services practice. When a family friend, whom had been in the business over a decade, learned that I would be starting my own practice, he was quick to offer two pieces of advice. First, “treat everyone you sit down with like they are your mother and father”. Second, “the first three to five years are rough. After that, you’re in the clear.” He was definitely right about the second part. The business model for a financial services practice is really simple. You live on the commissions from every financial product your clients buy. Financial products fall into two different categories insurance (life, disability, long-term care, annuities, etc.) and investment accounts (IRAs, 529 plans, brokerage accounts, and more). Different families of products require representatives to earn different licensing enabling legal brokership of a sale. The more tests passed, the more products you offer and the more money you can make. I passed my Life, Accident and Health Exam in May of 2014, allowing me to sell insurance products in the state of Pennsylvania. I would pass the series 63 and series 6 exam by January 2015. I found more than 20 clients in my first 6 months, above average for someone just getting started, and received lots of encouragement from my managers. But I could not shake the feeling that something was not right. The reality of living off 100% commissions left me unable to shut off the sales side of my brain. I started seeing family members, friends, teammates and acquaintances as little more than potential clients. The incentives of selling insurance versus the value of helping my clients was further perverted by the language of the laws regulating my behavior. My licensing required that I abide by a suitability standard. This meant I had to be able to prove a recommendation I made was suitable for my client at the time of the sale and kept diligent case notes. Sounds good right? The reality is that the suitability standard is a woefully neutered protection. What many clients need is a fiduciary to look out for their best interests. The difference between suitability and fiduciary is summed up simply: an advisor acting as a fiduciary, must act in the best interest of the client and put the interests of his/herself below those of the client. A suitability standard requires no such decency, instead insisting that the advisor's recommendation be reasonably suitable for the client while not guaranteeing that the client’s interests hold supremacy over the advisor’s. Brokers who are only limited by suitability requirements are free to put their clients into higher fee investments that garner a higher commission for the salesman. A Charles Schwab disclosure neatly sums up the situation: “Schwab may pay a Schwab representative more for selling products or services on which Schwab makes more money.” Many people think this is ridiculous and have petitioned Congress to protect people from this behavior. Wall Street is fighting to preserve the status quo and stop legislation requiring a fiduciary standard for everyone in the financial services industry offering advice. Wall Street has deployed an army of lobbyists to fight the bill, claiming that the increased costs associated with a uniform fiduciary standard across the industry (compliance reporting and time associated with advisors doing appropriate due diligence on potential clients) would make financial advice too cost prohibitive. While a fiduciary standard may not be the only solution, as Michael Kitces argues, at the very least, salespeople and fiduciaries MUST be labeled differently. Someone should not be able to call themselves an advisor if they are not putting their clients interests first. What you definitely do not want is an advisor who is fighting to keep his compliance department out of his business. You should also know when you are talking to a salesperson. Where did these realizations leave me? I feel the industry is ripe for disruption from tech start-ups like Wealthfront and Betterment. These businesses have already acquired over $1 billion under management, predominantly belonging to tech-savvy millennials. Their primary advantage is that they can charge SIGNIFICANTLY lower sales charges to investors, which have a huge impact on long-term gains. I did not want to spend the next decade or two fighting for scraps with such companies. Will advisors go the way of Blockbuster, Borders, and Kodak? Probably not overnight, but the new players are going to eat unprepared firms’ lunches and steal a lot of the pie. The millennial generation trusts people less and technology more than any previous generation. Generation Z will only continue that trend. I feel like I have just enough information and experience to give some advice to my peers if they come to me. If I do not know, I will happily direct them to resources and bloggers that can provide better guidance. Don’t get it twisted though, I have learned some useful information about financial planning. Here is what I am implementing in my own financial life moving forward.

If you agree or disagree, start the conversation below in the comments. Disclaimer; Everything you read above is my opinion and story. Nothing you read is intended to represent specific advice to implement in your own personal finances.

The best stuff from all around the web; read, learn and prosper.

The 16 key metrics for any startup (Andreesen Horowitz) Legalize prostitution (Vox) Text based games are the beginning of more games in the classroom (Games and Learning) Josh Brown’s trick for dealing with the market downturn (Reformed Broker) The wealthy have the same pastime in common (Business Insider) Find your urban tribe and have a prosperous joyful life (Money Mustache) Be sure to share your favorite links. |

Topics

All

If you want to support this blog, buy your Amazon products through this link.

Archives

August 2020

|

RSS Feed

RSS Feed