|

Darrin Grove, Truefit’s Founder and CEO, is a native Pittsburgher with a passion for innovation, technology, and values-based leadership.

Since its bootstrap beginnings in 1997, Truefit’s experience with new, disruptive technologies has positioned the company as a leader in helping entrepreneurs and organizations bring new software products to market quickly. Using their proprietary Idea Launch™ process, Darrin and the Truefit team guide clients through a proven path to create new and next generation software products. By involving a broad cross-section of company stakeholders, end users, and subject matter experts, Truefit helps product teams reduce risk and build confidence. Their principled approach and “start-up” mentality have proven to be an invaluable asset to companies looking for an entrepreneurial approach to software product development. In addition to his work at Truefit, Darrin is dedicated to sharing his insight in innovation and entrepreneurship with the Pittsburgh community. He leads the Deal Flow Team for Software and Technology at BlueTree Allied Angels and advises start-up companies at the AlphaLab tech accelerator. He is also active on several non-profit boards to promote leadership, education, and urban renewal, and is a regular panelist and judge at events related to innovation. Darrin’s Challenge; Think small. Focus on the small executions, pivots, and iterations that will move your work forward. Never miss one of our best episodes by subscribing to the newsletter.

Resources Mentioned

Lean Startup by Eric Reis Prospect The Sandler Way by John Rosso Good to Great by Jim Collins Agile Manifesto Connect with Darrin Website If you liked this interview, check out my other interviews with Pittsburgh entrepreneurs.

Underwritten by Piper Creative

Piper Creative creates podcasts, vlogs, and videos for companies. Our clients become better storytellers. How? Click here and Learn more. We work with Fortune 500s, medium-sized companies, and entrepreneurs. Sign up for one of Piper’s weekly newsletters. We curate links to Expand your Mind, Fill your Heart, and Grow your Tribe. Follow Piper as we grow YouTube Subscribe on iTunes | Stitcher | Overcast | PodBay

2 Comments

“If the rust belt has come to define the hollowed out industries of the Midwest, in the next ten years the paper belt will come to define the paper-based industries from Washington DC to Boston. In DC, they print money, visas, and laws on paper. In Delaware, companies incorporate on paper. In NYC, they print media on paper. And in Boston Harvard and MIT print diplomas on paper. I am dedicated to lighting the paper belt on fire.”

That’s straight from Michael’s profile. Before co-founding 1517 Fund, Michael Gibson was vice president for grants at the Thiel Foundation and a principal at Thiel Capital. For nearly five years working for Peter Thiel, he has contributed research to Peter’s global macro hedge fund, assisted in teaching a course at Stanford Law School on sovereignty and technological change, and helped run the Thiel Fellowship. He serves on the board of the Seasteading Institute. Before his academic apostasy, he was working towards a doctorate in philosophy at the University of Oxford. Attend my one-day conference January 27th in Pittsburgh. Learn more here. Michael’s Challenge; 2017 is the 500th anniversary of the 95 theses. Write you own declaration and post it somewhere in public. Connect with Michael Website info@1517.com If you liked this interview, check out our most popular interviews. Subscribe on iTunes | Stitcher | Overcast | PodBay

Kenny Chen serves as the Program Director of Ascender, where he focuses his attention on curating and delivering innovation programs and building collaborative relationships with people and organizations throughout Pittsburgh, as well as nationally and internationally.

This culminates each year with the Thrival Innovation + Music Festival, which brings together local and international influencers for multiple days of innovation-focused programs followed by a two-day outdoor music experience. On the side, Kenny is the co-founder of involveMINT, and serves on the boards for the Pittsburgh Entrepreneurs Forum and Social Venture Partners. Kenny was born in Madison, WI, raised in Las Vegas, NV, and graduated from UC Berkeley with a degree in Social Psychology. He has worked in several places around the world, including San Francisco, Washington DC, Taiwan, and Hong Kong. He came to Pittsburgh in 2014 for the Coro Fellowship in Public Affairs, a transformative experience that quickly gave him a wide breadth of knowledge and a deep love for the city. Attend my one-day conference in Pittsburgh. Learn more here.

Kenny’s Challenge; Intentionally seek out opportunities to interact with and learn from someone who doesn’t share your beliefs, views, or background.

Connect with Kenny Chen

LinkedIn

Website If you liked this interview, check out all my interviews with the people shaping the future of Pittsburgh. Subscribe on iTunes | Stitcher | Overcast | PodBay

Erik Voorhees, CEO of leading digital asset exchange ShapeShift.io, is among the top-recognized serial Bitcoin advocates and entrepreneurs, understanding Bitcoin as one of the most important inventions ever created by humanity. Erik's former project, the groundbreaking gaming phenomenon SatoshiDICE, was, at its peak, responsible for more than half of all Bitcoin transactions on Earth and popularized the concept of "provable fairness."

Erik humbly suggests that there is no such thing as a “free market” when the institution of money itself is centrally planned and controlled. His work is about the human struggle for the separation of money and state, and about Bitcoin as the instrument by which it will happen. Erik’s Challenge; Get some Bitcoin and learn how to use it. Block explorer Connect with Erik Website Books Digital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent Money by Nathaniel Popper How Money Got Free: Bitcoin and the Fight for the Future of Finance by Brian Patrick Eha If you liked this interview, check out all of my blockchain and crypto related interviews. Subscribe on iTunes | Stitcher | Overcast | PodBay

Underwritten by Piper Creative

Piper Creative creates podcasts, vlogs, and videos for companies. Our clients become better storytellers. How? Click here and Learn more. We work with Fortune 500s, medium-sized companies, and entrepreneurs. Sign up for one of Piper’s weekly newsletters. We curate links to Expand your Mind, Fill your Heart, and Grow your Tribe. Follow Piper as we grow YouTube Subscribe on iTunes | Stitcher | Overcast | PodBay

Transcript

Aaron Watson: Well, Eric, thank you so much for sharing some of your time with us today and coming on Going Deep with Aaron Watson. Erik Voorhees: Yeah, thank you so much for having me on the show. Aaron Watson: I'm sure that just even seeing your name in the title of this episode will drive members who are active in the crypto community to come and listen in. But a sizable portion of our audience is still really just trying to grasp blockchain, Bitcoin, crypto, this entire space. And so in doing my research and looking through your blog, there was a quote, or a line, that I saw that's particularly captivating and represents the mentality or the view that a lot of fellow early adopters of cryptocurrencies and Bitcoin were into. And that is that you humbly suggest that there is no such thing as a free market when the institution of money itself is centrally planned and controlled. Now that, in and of itself, is a huge statement, but I want to maybe just jump into your story a little bit. Where did you develop that viewpoint? When did you come across it? And why is that so fundamental that you put it in the bio on your blog? Erik Voorhees: Yeah. Great question. So, so basically I've always been a free market kind of guy. And after college, I moved to Dubai and was there during 2008 and 2009. And while I was over there, I saw the financial crisis unfold. And I got really interested in it, partly because it was such a big deal and partly just because being physically, so, so far away from where it was happening, I just got sort of this like observer's mentality and I was really interested in how it was all playing out and really was curious why it was happening and what was at the root of it, and pretty, pretty quickly started coming to the conclusion that something was wrong with money itself, that the way that money worked specifically Fiat money, which means money that has value only by decree of a government, how that all works through society. And ultimately started realizing that money is just another good, like anything else. And so anyone who understands the importance of a market probably understands that if there's only one monopoly provider of a good, that can be problematic. And yet, people are used to, and often encourage the fact that there's only one monopoly provider of money in any given country. So in the US that monopoly provider is the Federal Reserve, and everyone uses US dollars, which is just a product of the Federal Reserve. And it started to just be very clear to me that you can't actually have a market economy if the most important good, which is half of every transaction - money itself - is essentially planned and controlled. Markets are too complicated for any organization to centrally plan, how goods are created and distributed, especially one as important as money. So that was sort of my realization during that time. And it was a couple of years later that I learned about Bitcoin and found it to be the ultimate antidote to that problem. Aaron Watson: So, what were your next steps upon discovering it? Where were you doing your research or educating yourself in those very nascent stages? Erik Voorhees: Nascent stages of Bitcoin? So, this was May of 2011. Early May. And already, by that time, there was a lot of information about Bitcoin. There were forums and articles and I just, I dove into it with a, with sort of an intellectual curiosity that I had never experienced before. It was something that I, realized after it hour, that this was going to totally change the world and it was very much an addiction. And so I just learned everything I could about it. And very quickly realized that I was one of the only people involved in Bitcoin at the time that was not a technical person. I'm not a computer engineer or software developer. So I sort of had to understand it from a high level and not from a very technical level. And I think that helped me early on to, to communicate it to other people. And I just became completely addicted to the whole community, and thank goodness it was also able to be a career change. Aaron Watson: Yeah, absolutely. You've created a number of, or been a part of a number of different projects in the blockchain world, in the Bitcoin world. Satoshi Dice, at one point, was responsible for a massive amount of transactions on the Bitcoin network. But your more recent project or your current project: Shapeshift.io. And you've also said that there are just thousands of good ideas in the crypto world waiting to be built. I'm curious at this present point in time, how you came to Shapeshift.io as the solution or what you were trying to solve and why that became the project of choice for you. Erik Voorhees: Yeah. Well, I think like many startups, Shapeshift came about because I wanted to do something in a certain way that I couldn't do. And basically this was early 2014, like January or February. And, I wanted to buy some other digital asset other than Bitcoin. And, I had a bunch of Bitcoin and I thought: if I have Bitcoin, I should just be able to instantly convert it into any other digital asset. It should not take me more than a second. Just like it does not take me more than a second to send an email. It should really be that easy. There should be no friction there. And yet all the exchanges that I looked out and saw, where you could buy these other assets, had various points of friction. First of all, you had to make an account which can take from an hour to several days, depending on what kind of verifications are needed. That already made it an absurd proposition to spend a couple of days on something. And then putting up vid orders and waiting for those to fill and waiting for deposits and withdrawals to happen and it was just too much. And I thought, someone needs to build a way to just magically snap your fingers and change one crypto asset into another, but it just hadn't been built yet. And so I started thinking about how it might be done and those thoughts led me to creating Shapeshift. And that was back before there were many other digital assets. It was pretty much 99% Bitcoin and a few other little ones that didn't matter. And I think a lot of people thought I was a little crazy for building an exchange between these different digital assets when the market was so tiny, but fast forward to today and the worlds thousands of digital assets worth over a hundred billion dollars in total. So, the timing was perfect. Aaron Watson: If you could go back in time and just compare perhaps what your expectations were for all these altcoins versus the reality that's played out. Has there anything that's been particularly surprising for you or any ideas that you really have maintained throughout the evolution of the space? Erik Voorhees: Good question. I think one thing that surprised me was when Bitcoin came out, it was referred to very quickly as a form of money, and as "cryptocurrency". And so when other coins came out, they were also referred to as "cryptocurrencies" and many people sort of felt that all of these things are just trying to be a means of payment and, one of the lessons that the industry should have learned at this point by now, and that I learned over the last few years is that many of these assets, blockchain tokens, digital assets, whatever you want to call them are not really currencies at all. They're not meant to be, they're not used as that. They represent other types of value and other use patterns. And if you have that mindset, you can understand how lots of these different digital assets can all coexist with each other. Some people that are still sort of stuck in their early Bitcoin mindset - that Bitcoin is cryptocurrency and that's anything else is cryptocurrency, and thus, they all compete with each other. That's I think a silly notion that people should get rid of and dismiss. And then the other thing I didn't see coming was this token sale phenomenon, which maybe we can get into more, but that was something that I don't think anyone appreciated two years ago. Aaron Watson: Yeah. And what's also interesting, to that same idea is the notion of people being rooted in a mindset of this being a zero sum game. And what I see, whether it's different Twitter accounts or people kind of speculating or putting their 2 cents in - often, it's very well based in "this is the technical shortcoming, or this is what's lacking in said crypto." And then there's a very distinct correlation between people's holdings and the crypto tokens or the coins that they are advocating for, and there's kind of a confirmation bias, so to speak, that people really kind of set up in their camp, and then that's where they vociferously defend. I think that that is potentially destructive and it's really just kind of a relic of older ways of thinking. Would you agree with that notion? What is your opinion? Erik Voorhees: Yeah, that's a very important insight. The best way for someone who's into Bitcoin, for example, to be interested in some of these other assets is for them to own them. So if someone out there has Bitcoin and they think only Bitcoin should exist, and it's the only one true digital asset, I would encourage you to go take 5% of your Bitcoin and turn it into something else, Ethereum or whatever. It doesn't really matter. You will find that you first start paying more attention to that other project. And start looking for why it can be useful and valuable, and you'll start to be excited when it appreciates and sad when it depreciates and over time, you'll start to realize that the reason that you were so sure that Bitcoin was the only one is because that was the only one that you actually held. It's just a total tribalistic mentality that people need to break out of. Aaron Watson: Yeah. And it's easy to default into that. And even, you're talking about people switching a Bitcoin portfolio. We may have a lot of listeners - we do have a lot of listeners who haven't even necessarily dipped their toe in the water yet. And I get emails after some of these previous interviews of, "I just feel like I'm not ready. I feel like I don't know what to do." You don't have to put your life savings in it. Erik Voorhees: Well you shouldn't. Aaron Watson: You don't have to put it some life changing amount of money. Yeah, it would be unwise, but even in terms of a significant chunk of your retirement portfolio right now, that's highly, highly speculative. But even to a small degree, just enough to make you start paying attention. That's where the real education comes into play. And that's fundamentally an idea of skin in the game. You're not going to care if you don't have any skin in the game. Erik Voorhees: Yeah, absolutely. Anyone at this point, anyone out there who. Who is at all interested in economics money, business technology, should have bought a hundred dollars worth of Bitcoin because it's a technology that is important enough for you to understand how to use it in the same way that at some point it became important for anyone to know how to use a computer or to know how to use email or Microsoft Word or Excel. Bitcoin and blockchain are a technology that are going to be around for a long time and they're going to affect all sorts of parts of the business world. You don't need to go buy a whole bunch of it as an investment. You should buy a little of it and start using it so you figure out how it works. And once you learn how it works and why it's useful, then you can start thinking about it from a financial investment perspective, but not before then. Aaron Watson: We previously had a guest on, by the name of Dennis Mortensen and he built an artificially intelligent assistant for scheduling meetings. And I learned more about where the current state of artificial intelligence is from two months of trying to use that, to schedule my meetings for me than I did in reading 500 tech crunch articles. There there's something fundamentally about learning things through doing, as opposed to just reading or looking from the outside. Erik Voorhees: Absolutely. I mean, think about riding a bike, right? You could study a textbook on how a bicycle worked in the physics and how they were created and who invented them and all the different types and all that. And you'd get on a bike and you're going to fall over. It doesn't matter how much you learn in that superficial way. There's some part of your brain that has to learn things by doing them, by experiencing them. And that's true whether you're talking about a bicycle or using a computer or learning how Bitcoin works. So, anyone who's even remotely interested in this stuff, just go buy a little bit of it and send it around to a friend. See how that works compared to sending $50 through a bank transfer to a friend, especially one in another country. And you'll very quickly come to understand why this stuff is so profound and so important. Aaron Watson: Yeah. And exciting. So another thing that I wanted to talk with you about: just a couple of weeks ago, we saw the announcement that Coinbase had raised 100 million dollars in funding. Earlier this year, you raised $10.4 million in a Series A, and I'm really curious - you know, we're kind of having these conversations for the layman, and then there's the conversations within the crypto community, so to speak, but there's this other conversation happening between institutional investors, venture capitalists, and people who are really active in this space and how different that must be from even five years ago to now. Given your background, not necessarily being so much technical, that is part of your job, part of your career has been the storytelling aspect of blockchain, of crypto. In the 2017 environment, can you just give us a little bit of insight into what the conversations look like in those potential investor pitches and meetings and the story that you're telling there about Prism and a Shapeshift? Erik Voorhees: Yeah. So, generally, I believe that Bitcoin is a new form of money and blockchains, more broadly, are going to change the entire structure of finance and many other things throughout the world. So every startup likes to think that they're doing something revolutionary, but if we're being honest, most of them are not. They're making a marginal improvement on some industry that already exists. If the crypto industry actually succeeds and lives up to its potential, it is going to fundamentally change the structure of how humans economically interact with each other. And so that's a very tall order. And, when I've talked to people, especially investors, regarding Shapeshift, if they don't also agree with that macro thesis, then the Shapeshift looks kind of silly and you're not going to get it. You're not going to understand what Shapeshift is doing or what we're building, unless you already take for granted the fact that this technology is going to revolutionize all of finance. So, that's sort of the turning point. And also many people, if you try to tell them all the reasons why this is stuff is cool and why it's going to change the world, they'll listen to you and they'll smile and nod. But what really gets them interested unfortunately, is when the price goes up. Which is the worst reason to get interested in this technology. But even the most sophisticated investors in the world - the VCs, they like to think they're the most sophisticated. Even they simply usually chase the crowd. And they were not interested in Bitcoin in 2013 when it was $200, but they are totally interested in it now when it's $4,000, even though it's the exact same asset. So that's been a struggle to convey. People that don't buy into the macro thesis generally are going to have a really hard time understanding any specific company involved in this. Aaron Watson: Right. Also, in this venture capital paradigm, you talked about them potentially being the most sophisticated investors. You also spoke a little bit earlier about this ICO phenomenon that has been just absolutely exploding in the last half a year - not even a full year, really. Can you just talk a little bit about your perspective if this is - to some degree, I feel like I hear so many people say that it is a bubble that maybe it's not because usually bubbles don't have everyone calling them - but what your perspective is on that, because from what I see, there's a lot of really interesting and exciting new projects being built and being funded off of this model, but at the same time, really, really high expectations for some of these protocols that are already valued at a hundred million dollars or more, and haven't even really existed for more than two years. Erik Voorhees: Yeah. So for your listeners, ICO stands for initial coin offering, which is sort of an unsophisticated term to represent projects or companies that create a blockchain token - which anyone can do, anyone can make a blockchain token - and then they sell those tokens in a sort of presale or crowdfunding type situation. And those tokens then trade on the open market, along with the sentiment of the people buying and selling them. And so this is a really amazing way to raise capital because it destroys borders. It destroys friction. Basically anyone of any age, anywhere in the world can create a token and issue it and receive funds - people buying their token from anywhere else in the world. It's absolutely fantastic. However, when you lower the bar to raising capital, not only are you going to get a bunch of projects that are awesome, that got funded, which otherwise wouldn't have, you get a bunch of projects that are crap, they get funded and, and they otherwise shouldn't have. And so that process is going to play out. Most tokens - just like most startups - are going to fail. And that's okay, because most, most new initiatives of any kind fail. But the model of selling tokens is completely valid. And it's absolutely in a bubble right now, just as Bitcoin was in a bubble in mid 2011 and late 2013. It's absolutely in a bubble. It'll correct. There'll be blood everywhere when people see some of these tokens lose 98% of their value. That's absolutely going to happen. But the model is valid, and over time, people will start to be more discerning and. Invest more in the, in the tokens of projects that have actual fundamental merit, just as the dot-com bubble - everyone was investing in anything that had a dot-com. And most of those projects were stupid and failed, but the internet itself was a success and people still invest in internet companies and dot-com companies today, many of which have become multi-billion dollar enterprises. So it's something that people should be very cognizant of. Realize that ultimately, a tokens value has to derive from the utility of the platform that it's connected to. And if something doesn't have utility, then that token is going to fall towards zero. So, people are gonna make a lot of money and lose a lot of money speculating on these tokens, but that's just a cool new phenomenon that's happening on top of this technology. Aaron Watson: When you look around at some of the projects that are ICOing, maybe not necessarily looking for a specific investing recommendation or endorsement, so to speak, but are there, in general, rules of thumb or projects or areas that you look to as being more promising in the near term compared to other areas that just seem really lost or hopeless for the time being? Erik Voorhees: Yeah, anyone that's just starting to get into the crypto world should not be looking at ICOs at all. If you're getting into the crypto world, you should focus on the core stuff like Bitcoin, Ethereum - learn those things. Those are the important assets and the real center of this ecosystem. As you start to learn about that stuff and you want to branch out into the more speculative projects, that's fine. But one of my concerns is that people hear about their friend who made a thousand percent on an ICO and that the person has never, ever used Bitcoin. They have no idea how a blockchain works and now they're diving into a highly speculative blockchain project. It's a recipe for disaster. In terms of which ICOs are good, there's not really a theme to them other than: the team needs to be reputable. If they haven't made any software yet at all, be extremely cautious. Like anyone promising that they will have a platform built in the future. That can be really risky. It doesn't mean it's wrong, but it can be really risky. And then of course, anything that's raised 50 or 100 million or 200 million dollars is almost certain to disappoint people if it hasn't been built yet. Because there's that many people holding that much value in the tokens, all of whom want some kind of appreciation and it's, it's far more likely that many of them will sell and the price of the token is going to collapse long before the platform ever gets built. Aaron Watson: Yeah, that's really good advice. They need to have something to show. And then the other really important point that I only recently came to appreciate - both, as you mentioned, with Bitcoin and Ethereum, and these other smaller token projects - is that technical team surrounding the project. So both Bitcoin Ethereum have a massive number of developers who are working in that area, they're building systems, they're building the technology to support this and have it continued to grow and scale. And that amount of talent bought in, like anything, is really where a lot of the network effects are taking place. Erik Voorhees: Yeah. One caveat is that many of these projects are not just cool new technology. They are actually trying to be operational businesses that make revenue or that provide some service that they gain use users. So if you're buying into a token sale, there has to be a reason why the token is going to have value and the organization is actually going to be successful and enduring. And just because you have 10 PhD engineers who were building like really scientifically cool stuff, that does not guarantee anything other than a bunch of people looking fancy on paper. Aaron Watson: Absolutely. I want to get back to Shapeshift here before we start wrapping up, Eric. With the portfolios that you're helping people put together, do you feel like you are targeting more of a consumer or an institutional market with that offering, or is that not something you really distinguish? Erik Voorhees: So, I think you're talking about Prism. Not Shapeshift, right? Aaron Watson: Yes. Erik Voorhees: Yeah. So, Prism is a new product of Shapeshift and it's a way for people to get exposure to a basket of digital assets in whatever allocation they want. So we're not helping people choose that portfolio. We're just giving a tool for people to build a portfolio in a safe and easy way. The current version of Prism is, I think, much more appropriate for end users or normal people that want to invest $500 or $50,000 into a portfolio of crypto assets. It's not yet the right tool for a hedge fund that wants to buy $10 million of crypto assets. We will build it toward that goal as well. But for now we're starting off with just normal people and smaller portfolio sizes. Aaron Watson: Gotcha. And then the last question here, before we start wrapping up: in the last month, the other big news event has been the Bitcoin hard fork, the creation of Bitcoin cash, the introduction of SegWit, and a subsequent small rise in the price of Bitcoin. All of those, like you said, the price shouldn't be the most important data point for people, but in terms of what you've learned about the community, or crypto in general, what's the biggest learning you've taken away from the last month of development? Erik Voorhees: So yeah, the Bitcoin hard fork was a really big event in Bitcoin's history. It has never had a serious hard fork before. And a lot of people predicted doom and chaos - when you have a contentious hard fork where a portion of the community forks away and you now have two different Bitcoins. But, it actually makes things more peaceful. When you have a community as large as what's involved in Bitcoin, and there's a fundamental disagreement on some of its design, it's great if people can work out their differences and find common ground to move forward together, but ultimately if they can't, maybe they should separate. And then there's two versions of the thing. Both of them trade freely in the marketplace and one or both can win longterm in the market. So I think the most important lesson from this Bitcoin fork is, is that forks can be okay. They don't need to be seen as this horrible thing. And the Ethereum hard fork that happened last year demonstrated the same point. They usually cause a lot of volatility and uncertainty in the short term. And even some brand and reputational damage and some price collapse in the short term. But longterm, they can make the ecosystem and the technology healthier because they allow a community that is at odds to part ways. So, I think that's going to be an important lesson for people that are looking back on this phase of Bitcoin's growth to learn. Aaron Watson: Yeah, I totally agree and I think that that's a really important distinction between the short term and the long term impact of these types of occurrences. Eric, this has been great. I want to thank you so much for coming on the podcast. As we aim towards wrapping up before we ask our last two questions, is there anything that you were hoping to say today that I didn't give you the chance to? Erik Voorhees: No. Great questions. Aaron Watson: Thanks man. If people want to connect with you, learn more about Shapeshift and all the awesome stuff that you're doing, what digital coordinates can we point people towards to connect and learn more? Erik Voorhees: Shapeshift.io is our website. If you're just getting into Bitcoin, Shapeshift is not really going to be helpful to you. It's more for people that have already started learning about Bitcoin and are trying to get into other digital assets. So I'd recommend if you're just getting into this stuff to go read a book about it, like Digital Gold or How Money Got Free and learn about why this stuff exists and why it's important. And then, you can connect with me on Twitter. It's @ErikVoorhees. And otherwise, I think that's it. Aaron Watson: Awesome. We'll be sure to link that in the show notes, goingdeepwithaaron.com/podcast is the place to find it for this and every episode of the show. But as we do at the end of each interview, Eric, I want to give you the mic one final time to issue an actionable personal challenge for the audience. Erik Voorhees: My challenge would definitely be that anyone who's interested in this stuff needs to have a little bit of Bitcoin and learn how to use it and go send it to someone. Have a friend set up a wallet and you get a wallet and go get some Bitcoin and send from one to the other and see how that works. See how a block explorer works and how you can view a transaction on the open public ledger and what that looks like. Go do that. That's as important as learning how an email was sent in the early nineties. And this technology will start to pull you in and it can be a little scary at first, and confusing, but it absolutely is the future of finance and people should take some time, a long afternoon and figure it out. Aaron Watson: Yeah, absolutely. And I also love the part about exchanging with a friend. You can go down the rabbit hole by yourself, but when you have someone else to provide a little perspective, bounce, some ideas off of, that definitely gives you more balanced view on things. Eric, this has been fantastic. Thank you so much for sharing your time and wisdom with us today. Erik Voorhees: Thanks a lot for having me on the show. Aaron, Aaron Watson: We just went deep with Eric Voorhees. Hope everyone out there has a fantastic day.

Mark joined WebKite in the summer of 2016 out of his excitement for the advertising technology space and the powerful products WebKite has developed to date. Machine learning and language technologies can do so much still to connect consumers to the products they need, and WebKite will continue to be a major player in that work.

When not at work, Mark can be found serving as his neighborhood’s borough councilman, an advisor to small and family-owned businesses, a sous chef for his lovely wife’s kitchen creations, and the kooky uncle to his cute niece Lindsey. Mark is a Carnegie Mellon University graduate who has been working as the CEO of early-stage software companies for about five years. His first company, Student InTuition, merged to form Imagine Careers, Inc., a first-of-its-kind career discovery and engagement platform in the human capital space. WebKite, Inc. is an advertising technology company leveraging machine learning to create the most efficient and specific advertising campaigns on the web. With PPC, Remarketing, and Display products across a number of sectors, we make your inventory soar! Mark’s Challenge; Find a business in your local community and find a skill or service that could be useful to them. Resources Google Adwords Certification Never miss one of our best episodes by subscribing to the newsletter. Connect with Mark Website If you liked this interview, check out all of our interviews with the most influential people of Pittsburgh. Subscribe on iTunes | Stitcher | Overcast | PodBay

Barry Rabkin has over a decade of success founding, growing, and selling technology companies. An operational and strategic business leader, Barry's experience ranges from high growth, venture backed startups to Fortune 500 companies. He has also contributed to the development of over 100 successful physical and digital products.

Barry is proud to serve as Chief Marketing Officer of Identified Technologies, President of Hackers & Founders - PGH Chapter, Board Director of Jewish Family & Children's Services, He is also a guest Professor at Carnegie Mellon University and Strategist at Barry Brands Consulting where he advises and invests in many of the region's fastest growing startups. Barry’s Challenge; Write out your do list for the day and systematically eliminate everything getting in the way of your primary goal. Never miss one of our best episodes by subscribing to the newsletter. Connect with Barry Website If you liked this interview, check out episode 43 with Dick Zhang where we discuss Identified Technology for the first time, drone innovation, and entrepreneurship.

Underwritten by Piper Creative

Piper Creative creates podcasts, vlogs, and videos for companies. Our clients become better storytellers. How? Click here and Learn more. We work with Fortune 500s, medium-sized companies, and entrepreneurs. Sign up for one of Piper’s weekly newsletters. We curate links to Expand your Mind, Fill your Heart, and Grow your Tribe. Follow Piper as we grow YouTube Subscribe on iTunes | Stitcher | Overcast | PodBay

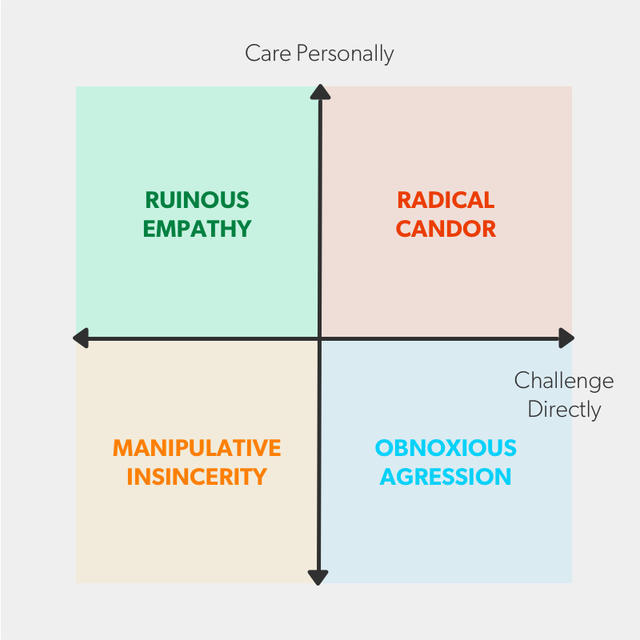

Today episode is a conversation about Truth and Love. Both are often missing from our daily interactions, and Kim Scott wants to fix that.

Here NYT and WSJ bestselling book Radical Candor covers the leadership and communication lessons she learned while working for Sheryl Sandberg & Sergey Brin and Google and with Steve Jobs at Apple. Whether you are a leader, consultant, or employee, you will benefit from injecting more radical candor into your meetings and discussion. Kim’s Challenge; Focus on soliciting radical candor from someone you works with Book Radical Candor: Be a Kick-Ass Boss Without Losing Your Humanity by Kim Scott Never miss one of our best episodes by subscribing to the newsletter. Connect with Kim Website If you liked this interview, check out our other most popular episodes. Subscribe on iTunes | Stitcher | Overcast | PodBay 234 Aaron Klein, Managing Risk, Common Investing Mistakes & the Future of Financial Advising8/2/2017

Risk is a word with numerous definitions. Riskalyze helps investors negotiate the risks they face.

Aaron Klein is the quintessential entrepreneur, spending his entire career working with entrepreneurial businesses at the intersection of finance and technology. He’s led companies or teams working on business operations software, payments technology for political candidates and causes, and mobile strategies for trading tools. He co-founded Riskalyze in 2011 and has led the company through the building of its core technology. The company has grown to support over $2 billion in portfolios and twice been named one of The World’s Top 10 Most Innovative Companies in Finance by Fast Company Magazine. Aaron’s Challenge; Find an apprenticeship to gain experience before starting your first business. Resources Nick Murray Never miss one of our best episodes by subscribing to the newsletter. Connect with Aaron Website If you liked this interview, check out my interview with Wealthfront CEO Andy Rachleff and all of our other finance-related episodes. Subscribe on iTunes | Stitcher | Overcast | PodBay |

Show NotesFind links and information referenced in each episode. Archives

August 2023

|

RSS Feed

RSS Feed