|

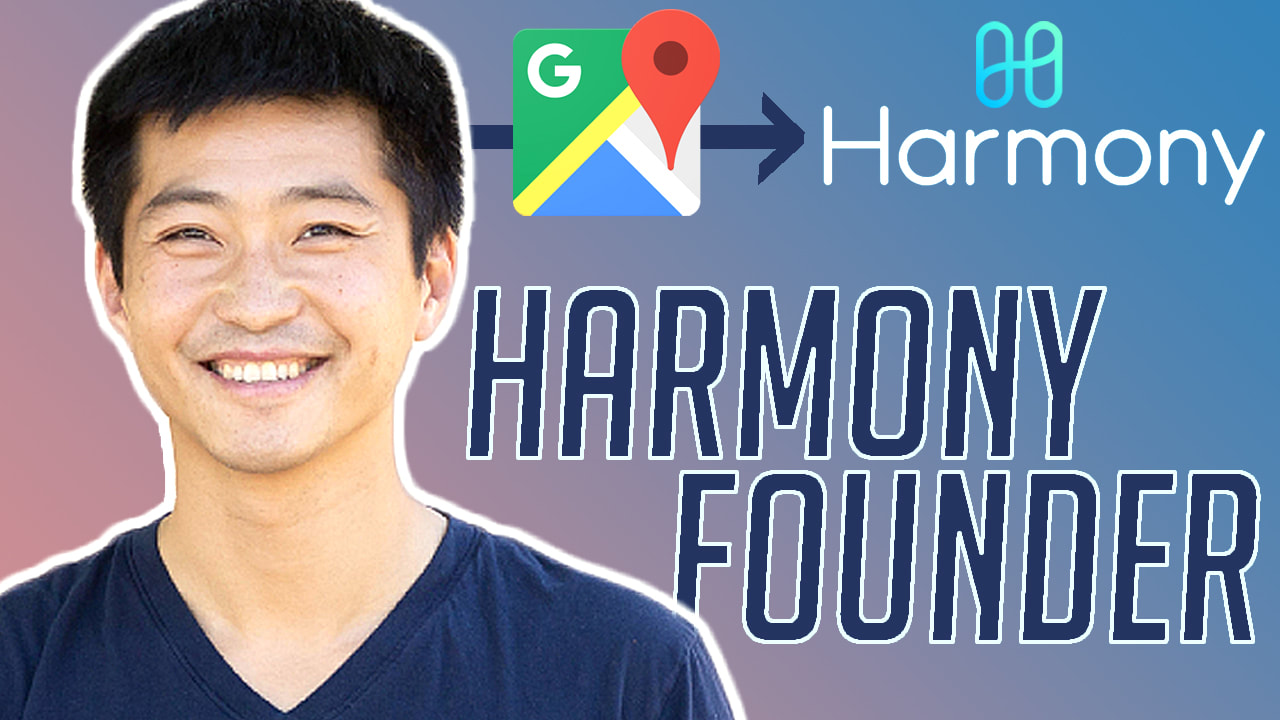

Stephen Tse, is founder and CEO of Harmony.one. Harmony is a blockchain-based open source development project with its own cryptocurrency.

Stephen has been obsessed with protocols and compilers since high school. He reverse-engineered ICQ and X11 protocols, coded in OCaml for more than 15 years, and graduated with a doctoral degree in security protocols and compiler verification from the University of Pennsylvania. Prior to founding Harmony, he has worked a researcher at Microsoft, a senior infrastructure engineer at Google, and sold his startup, Spotsetter, to Apple. In this conversation, Stephen and Aaron discuss how a blockchain project is like a traditional startup, the technical tradeoffs of blockchains, and how Stephen expects future projects to work together. Sign up for a Weekly Email that will Expand Your Mind. Stephen Tse’s Challenge; Set up a monthly newsletter to your close friends and family to keep them updated on recent events. Connect with Stephen Tse

Linkedin

Harmony.one Website If you liked this interview, check out our library of past episodes with blockchain innovators, investors, and entreprenuers.

Underwritten by Piper Creative

Piper Creative makes creating podcasts, vlogs, and videos easy. How? Click here and Learn more. We work with Fortune 500s, medium-sized companies, and entrepreneurs. Follow Piper as we grow YouTube Subscribe on iTunes | Stitcher | Overcast | Spotify Tse: The broader picture the harmony is in or where technology is at novel blockchain. It's really about a FinTech revolution. Watson: Hey everyone. Welcome back to going deeper there. And Watson, my guest today is Stephen Tse Stephen is the founder of the harmony blockchain project. It is not only a cryptocurrency, but a internet protocol that is focused on connecting different. Blockchain projects together to create more liquidity, faster transaction times and lower fees for everyone involved. It's a pretty lofty goal. It is definitely technically. Complex and above my pay grade, frankly, uh, but tried to make sense of it and get some wisdom, insight perspective from Steven in his position, operating the project. Uh, if you are a completely unfamiliar with how Bitcoin works, how Ethereum works, then I would hesitate to recommend continuing listening to this episode, I'd recommend either visiting past episodes of this show that we've linked in the show notes. Or other resources around the internet to familiarize yourself with those projects. First in my experience, most context around cryptocurrencies and blockchain. Start with understanding Bitcoin follow by beginning to understand and Ethereum and then everything kind of spirals outwards from that. But once you have that context, I'm fairly confident that you will find this both valuable and insightful. And I hope that you enjoy it. Here is Stephen Tse Watson: All right, Steven. Thanks for coming on the podcast, man. I'm excited to be talking with you. Thank you, Aaron. So excited. So I'm going to start things off. We we've done different like crypto Bitcoin, blockchain, different types of interviews in the past. And you are the CEO and founder of a independent blockchain project called harmony. And to try and start things off, maybe we can just try to explain what harmony is and where it falls in this landscape, because there's so many technologists, there's so many, you know, coin market cap. A thousand different cryptocurrencies out there. It is exceptionally hard for people like me to keep it all straight. So where does this harmony and your project fall in that ecosystem? Tse: Thank you, Aaron, for actually your audience, having a background in technology, um, and a little bit about Bitcoin, but understanding what is the entrepreneurial journey? Uh, that bring harmony of the project. And why is it different from maybe some of the blockchain projects that some of you may have heard before? I think it comes from the main. Right. Uh, I think it's interesting that finally, um, there was many technology breakthrough that allow people to collaborate together and subsequently, uh, uh, around the open source project. Well, um, I think the theory I'm in harmony coming into places now, can there be a different platform that said, oh, we may have a contract to do freelance and we may have a global business. Like, um, different community that not only this community can come together, but they can build an economy out of it. I think that economic aspect it's interesting because finally people can share anything online and open source contribution comes into any, uh, any like a WhatsApp group or, um, telegram group. Well, how many really want to emphasize this? Can the epi community that can create an economy, if not? Watson: And so it is part of the preset position then that the coordination that's enabled by a shared ledger, a trustless ledger, uh, much, much in the way that Bitcoins trustless, this allows every transaction to occur without that intermediary that can be applied to just more activities beyond a simple, you know, transport of value for some external agreement. There's, there's the idea here that if every sort of agreement is codified, Okay. And those, um, qualifications can be executed quickly. Cause that's another, another issue here is, you know, basically from a, from a psychological standpoint, most of the mind share to the general public is Bitcoin and then maybe a theory, um, and then maybe like blockchain or crypto beyond that. And the reality is is that there's this, um, there's this impossible Trinity, right? To be trusted. To be secure and to be fast is very, very challenging. So, so you kind of are pointed at that, correct? Tse: Right. Well, thank you, Aaron. You summarized it better than I did. Uh, but most of all, bringing out some of the key topics, both technical, but also like why, right? Why is this different? Why there has to be another system rather than just a bunch of my consortium or liars? Try to figure it out. Why couldn't we do it on Bitcoin right now? I think what you've mentioned about, uh, there are still, uh, deep protocols. Uh, but I think your audience would love to know why that matters. I think the amazing thing is people finally find it will community or even open source project, or even Cisco into a Kickstarter to really find a way of making a difference in the world. What people couldn't figure out is, wow. It was possible 10 years ago. 12 years ago for Bitcoin to top up money or investment or store value. And then you can improve that as possible to that anything can be on it or it's not possible. And why we take this route is we are a bunch of Silicon valley engineers infrastructure guys does it cannot be that. Expensive or slow that we are still in the dial up era. I don't know whether you ever use a slow modem and play with life like windows period of time, where they carry your map off you it's just too slow to do anything. Why would anyone do it that style compared to just go into the office ticket box? It's where we are exactly right. It is okay to tell the user and say, oh, now you can create money to your own community. But it's not so easy to lose money. It's not secure. It's so slow. It's so painful. You'll rather just like mail check, right? If it's so slow and then worst of all is it really doesn't work for people other than the few thousands people that'd been playing with the technology until I will say condition. Watson: And so to try to provide more clarity of where harmony lands in the ecosystem. You know, the, the different things that I'm aware of are the concept of like layer one layer, two layer layer three in the, in the traditional analog sets. So I might have cash and I might hand that cash to the bank, and then I might get a credit card somewhere else. And when I'm swiping that credit card, the money isn't immediately moving out of my account. Those kind of transactions are reconciled later on down the road, out of my bank account and that credit card. Is optimized for speed. And the cash is kind of optimized more towards being secure cash that is relatively stable. It's Fiat, the whole everything is that there's yacht, but it is still a well-worn technology to you, a Fiat based currency. So, so where can, can you paint, uh, maybe using that medicine? Where harmony lands Tse: really actually, it's a really great hierarchy. If not an Archer to think about it. As a matter of fact, maybe it's telling the audience I'm on entrepreneurship fundraising, if not a little bit investment, the broader picture the harmony is in or where technology is at alpha. Blockchain is really about a FinTech. The financial technology and solution, right? For the longest time, we can only play with my personal computing or what technological information. I think this decade, the entire time. It's exactly to what you just said, right? Different stacks, different layers of, uh, of our day-to-day life related to our economy activities. Most of our financial instruments, wherever the Capital has been provided, the only government you will trust to solve the problem. This one, you mentioned about different layers. So let me quickly touch on that. I'm not going to go into like the whole money supply waste of money coming from how the fed is printing money, I think is pretty well known by now. Well, it's the naughtiest going and we're how many position maybe you give me a good framework to clean. Two people will understand it become by now. I hope I feel it should be by now. It is really like the gold, right? Like digital gold. You need to trust it. You know, it's going to be there. It will be limited supply. You can really, it's just like, it's not going to disappear. People cannot make it right. Good, uh, limitation. So people consider that a slow value. That's all good, but people can normally do any sane about it. Right. We cannot create new economy top all at different application or contract the way that internet enabled Twitter, Facebook. So you do them to stop. Right. The second layer of allowing people, not just about me sending you a package, which is like a network. You have an eye on the internet, they can sent you a package, but, uh, nuclear might allow you to say, oh, now we can have email. Right. Very slow. But at least we can exchange an email. Well, how many will you want to be able to use? It should be allowing to do anything right now. You're doing on entrepreneur, but it has a value attached. Well, we're still very far from there, right? Otherwise you would be doing somewhat form four, even though my mom and pop. Right. The hardest of all is you sell, dealing with banks and government definitely base we'll work with flushing. Can we have that love for that? Everyone can really use that. How many, one position at that layer or level on top of harm? Uh, do you want me to mountain top Bitcoin at that? That's all to say that while it will be your day-to-day life, uh, not just the product, but like any other things that you want to do with the community. People you don't need to trust, honestly, but in you transact. Watson: And what's so challenging to kind of wrap your mind around here is in the same way we used these layers of legacy financial rails to illustrate me swiping a credit card. There's also layers and layers of technology that helped me, you know, set up this zoom call or send my emails and use the G suite within Google or use Google maps. And so th-the way. I'm trying to kind of like force myself to think creatively is, you know, the analogy. The other analogy is the first time that they set up a website for a new space, it was basically the front page of the newspaper turned into a website. There was, there was like side stories and the story in the middle. And eventually we realized that's not the optimal way to consume something in a digital format. We had to kind of rethink it. But the first step was to just take something from the old world. And push it into this new paradigm. And then we have to kind of start to learn how this changes, maybe the constraints or the obstructions, and allows us to go in some of those different directions, right? Tse: exactly. That's great analogy. People don't remember how we even do email sharing information before like web right. People that should go and remember that they, uh, day-to-day uh, to hold they were taken with other phone. Uh, I was right there. Right. I was using like developing, operating system called Linux in my high school, first version, and then doing web development. I was on the cool maps team when people didn't even think it was possible to be a, such an application out on their website. Right. Just click the click. You can already direct allow that. 12-12, 15 years ago, I'm showing my age. And then the last one, the mobile, right. I have my iPhone one lighting out for a few years, all the way to add like 12 models of iPhone. That to talk about blockchain now is really early. You have to really believe that something is wrong. Something you can do it differently. That what you said about like, kind of your day-to-day life, all the systems that you use now can just be slapped on now. I would say yes, but no. Right. People asked, can all that AI data, privacy and disrupting all of the companies be possible. Now in blockchain, I would say yes. Okay. Not now. There are people that are trying really therapy all the time. The last few years. Tens of millions of are pouring the space. That is really not a lack of ambition, passion or that temps. But the amazing thing is, um, there are really builders to left, um, that keep going. And, uh, it has been exciting the last few months. Watson: So I want to talk a little bit about the start and then we can kind of catch up to where things stand in the present. Because another thing that we've explored a lot on this show are these basic kind of two-- One much very well-worn in one relatively well-worn paths of entrepreneurship, the ones, the most common you bootstrap, a company, you find something to sell. You sell it. You keep doing that at a greater and greater scale and you grow from a one person shop into a a hundred person company. Then there's the model of the traditional VC, which is you go in and you have an idea. Maybe you have a concept for technology. This is something that you've done in the past. You get a seed investment, you start to develop that project and you're hopefully on this like hockey stick-stick type of ladder where you, you grow super-fast and you get a big series, a and a series B and some form of an exit via an acquisition or an initial public offering. These cryptocurrencies, these blockchain based projects don't really work in the same way. And they're tied into the open source software movement, and they're tied into these kind of very, uh, you know, digitally native communities type of framework. But can you kind of paint more of a picture of your story, which was you sold a company to apple. You decided to leave that position and start this thing and what you needed at the beginning in order to get any sort of momentum. Tse: Yeah, thank you, Aaron. Again for like we still talking about, well, the overall structure that people can still get on the startup journey and actually knowing what's ahead of them and what is possible now? Um, I think you need a slurry. Any entrepreneur, we map back to what we just said, right? It was so different 10 years ago for web and mobile. And now even for entrepreneurship is very different, right? As we know, Kickstarter and all kinds of online platform for a freelancer are quite possible. Right now. Whether you have a project, a hardware to ship, or you just want to get people to pay you monthly, even though you don't get sharing community fishing. And I would say the core of entrepreneurship, at least technology entrepreneurship in Silicon valley has also been quite. Okay. As well because of blockchain because of technology. Uh, so just to backtrack a little bit, uh, I, when I finished my PhD, I went to Google maps to work, and then it come to say goodbye to my first startup. At that time, I was fairly new to Silicon valley to know like, what are VC. And we went through that round. We raised more than a million, and then we sold to apple for google itself. Uh, but then, uh, both of AI and blockchain really changed my perspective. Do I want to repeat the same? Like, if you have to write a website again or to new podcast again, Completely different paradigm of tools you can use. It's not a blockchain, allow us to do it. So we quickly raise 80 million within a few weeks. It's not because of the, of the money is because now that you don't need to be so focused on just regional and, uh, That have certain trash in for certain GC said lots of people failed after getting a few tens of millions. Um, we were just so a little bit quite hardcore. I was just like having to build a mentality where you said like, oh, they're still users, even though you build that, it's still a true question. You only need to ask revenue. You don't need to show the chart, but you still need to keep in mind that it's not just about the train, but the product that make impacts people's lives. So for us, we quickly go on that journey to raise it on plot in about Money, but also feel it community. And I think that's. Melissa product or like a startup didn't even talk to the customer until, I don't know, six months or one year later, they don't even feel accountable to pop up to public five, seven years later. And blockchain kind of compressed all that into more than a year. Watson: And so would you call that an initial coin offering or is that not how you explain it? Tse: It was a, so we have to, we have to figure it out. So there are two way to think about it. Like, what is like, what does the IPO box slide after five, seven years? Usually you have to, you only figure out when you're five, seven years do the training. So you have to kind of figure it out in the first five. It's not five weeks. So if it could that be quite the token. Meaning all your community investors, your customers, how they will use this currency of this tokens is what people call it. The initial coin offering of the tokens token is just mean exchange of your share if you know, setting up C corporate measure. The other thing that we did is once we figured it out, we still want to keep it to the public now. And Watson: that's a really important idea there because there's like this, this risk or default to go it's paradigm, shifting everything is different, totally different. But at the same time, this idea that you might need to determine the economics of your project, right? At the very earliest stages, it's somewhat different. But at the same time, you start at, you have a startup and you say, okay, We're going to have a, a four year vesting period with a one-year cliff, for anyone that joins our company in order to have equity in this project that we're building together. So really this is just more variability in the model, more creativity for how that might be formed and where the kind of initial investment might come from and how people get a piece of it. But it's not really that different in the sense of like, Yeah, that's how it started. So I've always worked by finding an economic model that gets everyone together, working on the project at the same time. Tse:. Yeah. I still, you, you, you, you are really good at making analogies and I think that's what people need. I love it because like, it helped me to tie all your frequencies new as some details. What happened is, is exactly the same thing, right? It's exactly the same IPO, your customer acquisition strategy, but now you've put a incentive to it. It's just so many the technology has changed. So say having a website or newspaper allow you to publish by minutes in sublime one week later or the next day. But once the moment it goes out, everything's you soon check off track. You still get to have the distribution. There's nothing that allows you to get around, but how to do share and distribution. So coming back to Boston is a symptom, the money still really fast. I'm talking about seconds. Right. They are like, uh, two years ago, they are like, uh, 50 million guests sold in mid, like insane sort of timescale changed because of the technology. But what you said about the structure of an economy of a product of a company really haven't changed, but just compressed. Watson: And so can you talk from like a community standpoint about the incentivization of developers? Because the traditional model is, man, we have to figure out how much equity are we going to give this developer on? Is it one is a, three is a five is a 10% whatever. And you know, that's, that's the asset in order to get this thing built in the early stages. But now it could be something where maybe I'm full-time, maybe it's, maybe it's one of your old, when your old colleagues at a Google or an apple or something like that. Who's really technically sophisticated. Kind of can put in there 40 hours a week and one stack have some sort of project on the side and maybe it's 10 hours of contribution, but there's the motto where that works. Tse: Yeah. Um, I think that's another fundamental shift in this last year. If not this decade, I also see the FinTech revolution only because technology is changing, but humans behavior in humans, jumps to engagement is completely different the last few years, and last year, just push it all over, over the edge of it. So I can talk a little bit. Harmon you think about that, but I also can say how blockchain and napalm different level of freelancing, if not even open source. So I-I'm happy to a couple of both, but let me do a little bit more specific, probably you know, about freelance podcasts during audience, anyone, but, uh, but the open source and technology is also very, very unique and way more crazier than what I knew three years ago in the stock is apart. We know that open source is really where the future research human creativity company. Right. Everyone just contribute what people, if we could figure it out, it's just incentives, right? If every go and source, like how much did I get many open source prototypes because of it community couldn't stay together at one vision incentives doesn't make sense. No money there. The flip side of the coin is even though you figure it out, people can just copy it. Right. Just like podcasts. People actually do better as curator or distributor. A lot of them, the one actually doing the hard work of putting a content and philosophy technology together on some code. So in open source or in particular for a blockchain project, the hardest thing they call it a forging. Of a community or a project. Um, it just means that I copied it exactly the same. You, you put it out. I copy it. There's nothing wrong because we learned from the one before us as well. And we copied just as much, but how to keep them the value of the community and keep the incentives. Um, I would say it's actually still experimenting, like, as we talk about at the hundred million scale in the timeframe of the few nicks. So if you catch anything about decentralized finance deep by last year, that's exactly what happened. People just exactly copy it, but let me just boil it down and bring it back to the excitement to top our world, the product. This is truly where things are going or research or source code development or technical department mine, or the digital economy are very cloneable copy about. So I think it's actually normal. What they, what people would never have is a style level of capital injection. To make all these experiments worthwhile. I think back to your point, Kim, I can, I attract my colleagues that were going to come out to work on some new, to increase the risk giving is what, uh, this whole economy enable, um, many people on to try to last week. Watson: And so in terms of like your role, once again, it's like the CEO of this project. How is your. Like, how has your blending of responsibilities? Cause back to like old paradigms, you, you gotta do sales, you gotta have product, you gotta have some customer support. And to some degree you need to be driving the technical growth of the project. you need to be recruiting talent to be a part of the project, but then you also need to be pitching this as a sales person. To the potential, the people that aren't gonna be building are acting, they're just investors trying to speculate and make a return, yep. Tse: Well, speaking of pitching, let me pitch that anybody interested in technical or marketing for harmony, please come into on us, I know this is true. I mean, I used to be academically and research, but now it is everyday telling about. And I'm not sure whether you touch on one heart that dilemma is. We, uh, I call myself finder a lot more thinking about the CEO started this project, right? At the end of the day, this should be a community project. It should be an open project. Anyone can contribute, but also ticked out on the ship going forward. Right. I've been pulling my time. I've done it before. I've done one startup that I know that it really just heads on everything I saw entrepreneur. But what is difficult now is it's like, you have to, like, you have hundred of your podcast partners to do this project together and you want each of them to drive and in the future sustainable, I think that's the hard one of it become. Watson: It is at the same time though. So interesting. It's an insight into human behavior that both of these trustless, huge community, widely known projects, both Ethereum and Bitcoin, they both have like a figurehead, right? Satoshi, Nakamoto, and unknown character is the figure of the Bitcoin. The talk Buterin is the figurehead of Ethereum. So there is this like weird tension where you want to stimulate community, but at the same time, There's probably a human default to like, like we just had an inauguration here. Like who's the guy or the gal. Tse: Exactly, exactly. I think it is for sure. Like what are the typewriting divisions? So good. I would just follow even the same division or metallic, right? His yard. He's smart. He still eat it everyday. And he's. Uh, I think not only about having the right vision is not efficient to be a leader, but whether it's stay anonymous, pseudo anonymous, or just complete public, it's also the biggest challenge, right? The more involved you are hands-on and even doing the 30 that data, the more harder to be sustainable when it's with the value right. And the same thing, we have anonymous and public, right? Uh, there are quite a few successful project being a pseudo anonymous, all completely anonymous, but the trust may be so much higher. Right. And there are bad actors in this space. So I think back to the point about a public company only in Banda, what 200, 300 years. Right. If the point was, it's not about a founder that make all the decision for the next 10. If you read that case from here, I think it still makes sense. Watson: Um, so talk a little bit about like what you guys have been rolling out and working on lately. I know that interoperability is like one of the buzzwords. I don’t quite completely understand what that means. Tell me a little bit more about what you guys are. Tse: Of course. Yeah. That's all great here. And I think that's where, uh, you didn't miss any ethical. The price is not too high yet. This is still a good time to feel, uh, would love to tell you more like, like we, you can easily learn what happened. Uh, two or three years, if not 10, but what is exciting this two, three months, if not this year, maybe you would jump to this share. Maybe you'll learn something that connect back to, um, uh, the, uh, like other way of doing like, uh, entrepreneurship for your audience. I think blockchain is only a compressed, uh, landscape of my wife's possible genuine technology. We call it the inter-opera. I think it's really the end game of what open system or blockchain . So they are finally not just Ethereum, but multiple networks finally have a product, not just talking about like the token economies or like the ambition that came online just last year. I'm talking about the last six months. Right. Funny enough, he is, they all talk in their own way, their community in suddenly competing in some, but, uh, uh, like, uh, don't work with each other, but the broader vision to harmony, again, back to that, we can all work together. If we don't even get a few blocks to new work together, a lot of chances to get other communities, other, I don't know, gold of mine and, and banks to work together. Finally, that it makes sense now that we can should. Um, you and your team should be able to connect two different networks. If the use of the choose to, to work on any applications, we call it into the opera ball because it is still very hard. You need to go to something called centralized exchange, finance, Coinbase. That is great for like protecting users, getting educated by the end of the day, the choices of another system allow you to easily move any of the application. Most of all your data, your money, who is not bad. I mean, I worked there before apple. It's not bad, but you want the choices and it's only possible if it's interoperable, right? Just like back in time, you can port your phone number to any other new. Watson: Here's another metaphor might be appropriate. It might not be, we use Zapier, right? So we have this document management system and this invoicing system and this project management system, and they don't have a natural symbiosis, but they all have public facing API APIs that you, that zap you're not used. The app you're allows you to make relate to one another. And I created this document. So create this action over here on this software and save myself some time. Is this. Is Zapier more, the current exchanges and you're trying to replace them or you're trying to be the Zapier for people to use. Tse: Yeah, it is exactly that analogy. Uh, the whole idea of actually blockchain itself should be about that. Even if you just go, people are still fading, just like Facebook PTP, whether they are an API, that's open up, pay for logins time, it should be permissioned or permission loves. Right. So what we said about Sapio is the person nausea, right? Everyone wants that. But they couldn't figure out how much you open up, how much limited, how much it captured the value per API. Right? So is that the, that's a great analogy because it forced us everyone to see that by opening up, you actually capture far more value for most users from a usage. Right? So we also played a role to be the SAP here, but anyone can do this now, the API and the schemes and incentives on committed on. Watson: I, I think, um, I think I'm starting to get it, Steve, and I appreciate you. Tse: Uh, it's really good. Watson: Yeah. I appreciate you answering all my questions. Um, I want to ask our standard last two questions here, but before we get to that, anything else that you were hoping to share today that I just didn't give you the chance to? Tse: Yeah, I do. I do think that's, uh, it is not about people will find it, you know, that, uh, of course it has to be there. Yeah. I think, uh, the product message, I really felt like that, uh, the future can prepare. If you see the change of technology, and if you see some of the brightest minds that work on this problem and this problem, it's not particular, we're not just trying to figure out how to make something called faster than calling it gone. We actually think is quite fundamental that we can control our own, uh, economic health. It community should be having its own, say how to form and how to create wealth together. I think that's a broader in such way. Watson: I take that and I, I hope, uh, it comes to fruition very soon, folks that want to follow along, uh, and just kinda see what you guys are up to getting both in some way, shape or form. What did you coordinate? Do you want us to point people towards. Tse: yeah, please follow me on Twitter. I promise my team and the company, not just about talking to yourself and like the broader picture. And I have a really, really short too in the console. You cannot miss it. It's just. And then T S E. So I turned to it a long time ago when I see imagined. So my name is Steven. My last name is T S E so Kimmy on Twitter. Our website is called harmony dot one, H A R M O N Y dot O R G. So we really liked the branding. Uh, so check out some of the technical stuff, but like subscribe this here. We used to bring a little bit more industry insight, not just talking about the particular technology. Watson: Right on, uh, we're going to link that all in the show notes for this episode can find it in the podcast link or in the description behind the video, wherever you're listening to this right now, I'm also going deeper there and.com/podcast for every single episode of the show. But before we let you go, Stephen, I want to give you the mic one final time to issue an actionable personal challenge for the audience. Tse: Oh, yeah. Personal challenge. Huh? I think many of us have like a new year resolution, but I would like to add one that, uh, really kept me, uh, Going for the last few years, in some way, it changed me. I used to be a CTO researcher, but one thing really forced me to be a little bit more about the broader message. So now it's writing a month new phone, uh, not everyone would do well. Uh, as a matter of fact, that's what my first VC told me to do. It doesn't matter what you do. It's just how to even follow the audience down the entrepreneur or having VC to appear candidate. Watson: And even socially, just socially, like people are once they controlled paradigm versus the new paradigm, you send a Christmas card once a year, because that's what was affordable to like print and send to everyone. And in this type of environment and you can kind of do quarterly or monthly or whatever type of update. Yeah. Tse: Yeah. I would say challenge yourself to do it. Maybe it could be to some, the audience must not be like, just be monthly accountable. By the end of the quarter, which is more likely before April 1st, write a letter to 10 people that maybe a few pages, six pages on some style, because it really impacts me the first time I received such a letter from my last school, but also I go feel that really change the way I can make it Watson: Beautiful. Stephen, I love the challenge and I appreciate you spending so much time with us today. Thanks for teaching us about Tse: Clara and you will send me one, right? Absolutely. Yeah, Absolutely Watson: thank you. We just went deep with Stephen Tse overnight. There has a fantastic day. Tse: Thank you so much, Aaron. Love you guys. Thank you. I'd love to be here again. Watson: Hey, thank you so much for listening to the end of my interview with Stephen. If you enjoyed this, then make sure that you've listened to all of our past interviews with other blockchain innovators and entrepreneurs from Joe Lubin and Roger veer talking about Ethereum and Bitcoin back in 2016 to pump talking about the 2020 pandemic financial crisis and other associated issues. It's all here. It was going deep other great interviews. Very soon. Tse: Thanks for listening. Connect with Aaron on Twitter and Instagram at Aaron Watson, 59.

1 Comment

3/20/2023 05:07:43 pm

It's always inspiring to hear stories of people achieving their long-held ambitions, especially in the field of writing. Writing can be a challenging pursuit, requiring discipline, dedication, and a willingness to put in the time and effort necessary to hone one's craft.For writers in Frome, a town in Somerset, England, realizing their long-held ambitions of becoming published authors is an exciting accomplishment. Frome has a vibrant literary scene, with a number of writing groups and events that support local writers and provide opportunities for them to share their work.

Reply

Leave a Reply. |

Show NotesFind links and information referenced in each episode. Archives

August 2023

|

RSS Feed

RSS Feed